Congressional insider trading involves lawmakers who use their privileged information to trade stocks. Congressional insider trading is controversial because it involves elected officials using non-public information obtained through official duties for personal gain. This can lead to unfair advantages and damaging consequences for investors.

In this article, we’ll discuss how congressional insider trading impacts investors. More importantly, we will discuss how to use congressional insider trading to your advantage.

Congressional insider trading is a highly controversial issue that has attracted widespread public attention in recent years. While there are laws in place to prevent insider trading, there are currently no specific regulations that prevent members of Congress from engaging in this practice.

Most recently, former House Speaker Nancy Pelosi and her husband Paul have reignited the debate on congressional insider trading. Many Americans feel strongly that members of Congress should not be able to trade stocks, but what about their spouses?

PELOSI Act

In January 2023, Missouri Sen. Josh Hawley reintroduced the Preventing Elected Leaders from Owning Securities and Investments (PELOSI) Act. The bill would prohibit members of Congress and their spouses from trading or holding individual stocks. If found guilty of violating the proposed law, members of Congress would need to return the profits back to the American people.

Hawley proposed the bill after Nancy Pelosi and her husband Paul made tens of millions of dollars in just a few short months by trading stock options in some of the hottest tech companies, including Apple, Visa, Microsoft, Disney, and Tesla. The list is extensive.

However, one specific trade brought attention to Nancy and Paul’s trading strategy…

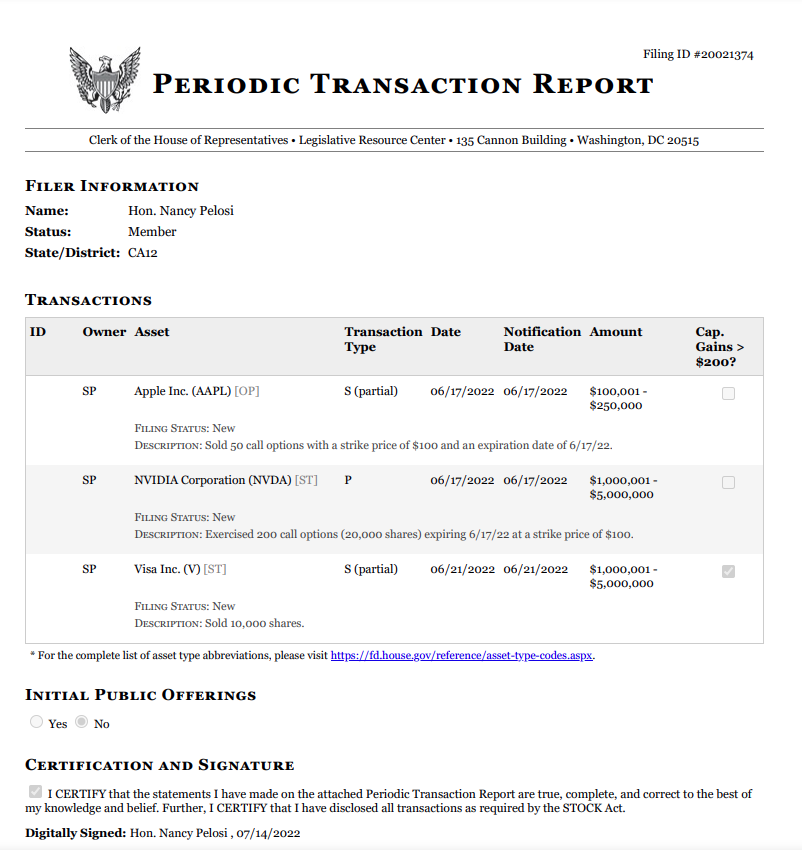

Nancy Pelosi reported these trades for her husband, as is the protocol, but what's suspicious about the trade is the timing. Mrs. Pelosi filed this periodic transaction report on July 14, 2022. Paul Pelosi’s multimillion-dollar trade on Nvidia (NASDAQ: NVDA) was right before two major semiconductor bills entered the House. It’s not unfathomable to think that Nancy told Paul about the CHIPS and FABS acts and what they would do for American semiconductor companies. It's textbook congressional insider trading.

It’s possible that Paul Pelosi is one of the best traders to ever live. The consistent timing of Paul’s trades paints a different picture, though. Nancy's and Paul’s profits are just one of many instances of congressional insider trading. While the PELOSI Act has not passed yet, it wouldn’t be the first bill of its kind. Learn more about Nancy Pelosi Stocks…

The STOCK Act

The issue of congressional insider trading first gained national attention in 2011. A report by CBS' 60 Minutes revealed that members of Congress were trading stocks based on non-public information. In turn, congressional insider trading leads to millions of dollars worth of profits.

In the wake of this scandal, a bipartisan group of lawmakers introduced the Stop Trading on Congressional Knowledge (STOCK) Act, which aimed to prohibit insider trading by members of Congress and their staff.

President Obama signed the STOCK Act into law in 2012, and it required members of Congress and their staff to disclose their trades within 45 days of making them. The act also required that the information be made available to the public online. This law was seen as a major victory for transparency and accountability, and it received broad support from both sides of the aisle.

However, the effectiveness of the STOCK Act has been called into question in recent years. In 2013, Congress passed a bill that removed some of the reporting requirements for staffers, and in 2017, the House of Representatives passed a bill that would have repealed the law altogether. While that bill was ultimately defeated, it underscores the ongoing debate over whether members of Congress should be subject to the same rules as the rest of us.

The Bipartisan Restoring Faith in Government Act

The latest pushback was a surprise to investors and lawmakers alike. On Tuesday, May 2nd, 2023, Rep. Alexandria Ocasio-Cortez (D-N.Y.) and Rep. Matt Gaetz (R-Fla.) along with Reps. Brian Fitzpatrick (R-Penn.) and Raja Krishnamoorthi (D-Ill.) introduced the Bipartisan Restoring Faith in Government Act. If passed, the law would prevent congressional members and any dependents from participating in the stock market. The bill was met with mixed reviews by their peers.

Rep. Nancy Pelosi (D-CA) expressed that it would be unfair to prohibit congressional members from participating in the free market in 2021. It's doubtful her stance has changed much since then. Rep. Mitt Romney (R-UT) expressed that even though it's a bipartisan bill, it would take "a lot of work" to pass. While Reps. Alexandria Ocasio-Cortez (D-N.Y.) and Rep. Matt Gaetz (R-Fla.) disagree on most issues, it's refreshing to see them come together on the issue of congressional insider trading.

Congressional insider trading continues to be a hotbed issue for both government officials and civilians alike. The Restoring Faith in Government Act has the chance to put an end to congressional insider trading once and for all. But the big question is, will it pass? Only time will tell.

Congressional Insider Trading and Investors

The issue of congressional insider trading is not just about ethics. It has real-world consequences for the average American. When lawmakers use insider information to make trades, they are gaming the system. This undermines the trust that Americans have in their elected representatives and erodes the integrity of our financial markets.

Not all congressional insider trading is illegal or frowned upon, though. Most of the time, it is acceptable as long as they follow the rules. In order for it to be considered legal, the insider making the trade must fill out Form 4. Once they fill out the form, they must send it to the SEC and disclose the trade publicly.

However, there is still something that doesn’t sit right with everyday Americans. Why should public officials triple their net worth while the rest of the country struggles — especially when they are able to trade using information about bills that they vote on?

Regardless of how you feel, the fact of the matter is congressional insider trading happens. Unless the PELOSI Act passes, members of Congress will continue to trade stocks.

It’s not just members of Congress who have gotten in trouble for insider trading, either. C-suite executives are also under a microscope when it comes to disclosing their trades to the public. In fact, the various signals of legal insider trades can be a buy indicator. Many successful investors employ the strategy of staking out company insiders to get an idea of how a stock will move.

Using Congressional Insider Trading to Your Advantage

Alex Boulden is a firm believer in this strategy. He has identified an elite group of investors that he calls “supertraders.” They consistently grow their fortunes every year, regardless of market sentiment. They almost never lose.

While it isn’t a sure thing, it is a fantastic indicator of when to buy or sell a stock. Think about it: If the CEO, CFO, and COO of a company are all buying a ton of company shares with no news, what do you think will happen? Chances are they believe the stock is getting ready to run. Since they are high-level executives at the company, they might be privy to information that the public doesn’t know about yet.

If company insiders are selling a stock in bulk, they are doing the same thing. If the C-suite executives are unloading a bunch of shares, it probably means bad news is on the horizon. This was the case for the Silicon Valley Bank executives who sold millions of dollars' worth of shares weeks before their historic collapse.

Alex has broken down the system so regular retail investors can take advantage. Whether it’s with company insiders or congressional insider trading, there is a way to stay ahead of the curve. Here’s how Alex Boulden and his team at Insider Stakeout are doing it.